What Does Surety Bond Solutions - M&T Bank Do?

Common such bonds are executor and administrator bonds, trustee bonds, guardian bonds, and conservator bonds. Required by statute for particular holders of public workplace, to protect the general public from impropriety by an authorities or from an authorities's failure to consistently carry out tasks. Public official bonds included county clerk bonds, tax collector bonds, notary bonds, and treasurer bonds.

Included are a large range of bonds, such as storage facility bonds, title bonds, utility bonds, and fuel tax bonds.

The Main Principles Of Public Official Personal Surety Bonds - Colorado General

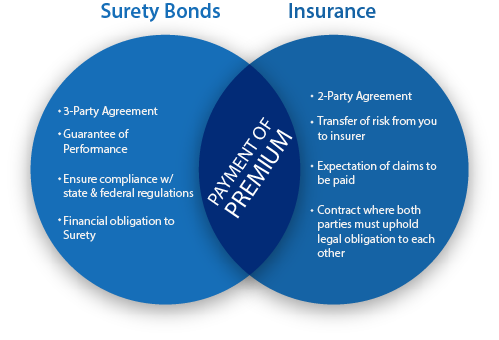

Discover the surety bond fundamentals with an easy-to-read summary of surety. You'll be a specialist in no time! What Does a Surety Bond Mean? A surety bond (pronounced "- ih-tee bond") can be defined in its most basic kind as a composed contract to guarantee compliance, payment, or performance of an act.

The 3 celebrations in a surety arrangement are: the celebration that acquires the bond and carries out an obligation to perform a serve as promised. the insurer or surety business that guarantees the obligation will be carried out. If the primary fails to perform the act as assured, the surety is contractually liable for losses sustained.

The smart Trick of Surety Bonds - Marsh That Nobody is Discussing

For the majority of surety bonds, the obligee is a regional, state or federal government organization. Surety Bond Need to Know In practice, surety bonds can have several variations to their definition, significance, and function depending upon the particular bond requirement. There are https://contractorinsurance.info/ of different types of surety bonds throughout the country.

Other surety bonds ensure payment of tax or other financial responsibilities. These bonds are described as "rigorous financial warranty" bonds and often times are more expensive due to fundamental danger of ensuring a payment as opposed to a compliance requirement. Another common type of surety bond called is referred to as a agreement bond.

The 5-Second Trick For Surety Bond Insurance - HUB International

Professionals took part in a variety of both government