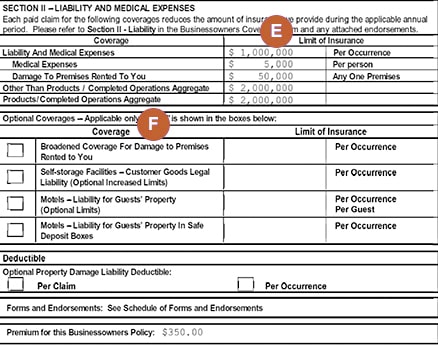

Individual obligation insurance coverage is particularly necessary because it may assist secure your individual assets in the celebration that a suit is filed versus you. Without obligation insurance coverage, you can be forced to pay manies thousand or also millions of dollars in legal expenses and damages, putting your financial savings and other assets at threat.

There are actually many styles of liability insurance plans on call to people, including general responsibility, qualified responsibility, item liability, and sunshade responsibility. Each kind of plan uses different degrees of security depending on the specific threats involved.

General Liability Insurance

Standard obligation insurance policy is a essential type of protection that guards people coming from case created against them for bodily injury, residential property damage, and personal injury. This style of plan commonly deals with lawful expenses and damages up to a particular quantity indicated in the policy.

For instance, if you mistakenly result in damage to someone's residential property while visiting their house or service, your general responsibility insurance policy would cover the cost of repair services up to your plan limitation. If someone slips and falls on your home and files a claim against you for their injuries, your general obligation plan would deal with the cost of legal expenses and any sort of harm awarded up to your plan limit.

Professional Liability Insurance

Qualified liability insurance coverage is designed for individuals who provide qualified companies or recommendations as component of their work. This type of protection secures against insurance claim created by clients alleging carelessness or errors in their work that led in financial loss or other harm.

For instance, if you are a professional who gives economic suggestions to clients and one of them experiences monetary losses as a end result of adhering to your insight, they may take legal action against you for harm. Qualified liability insurance policy would deal with the expense of lawful fees and any sort of damages granted up to your plan restriction.

More Details is created for people who make or offer products. This kind of protection protects versus case helped make by individuals declaring that a product created them damage or harm.

For example, if you market a house home appliance that breakdowns and induces a fire in someone's house, they might file suit you for damages. Item obligation insurance would deal with the cost of legal expenses and any kind of damages rewarded up to your plan restriction.

Umbrella Liability Insurance

Umbrella liability insurance is developed to deliver added coverage beyond the limits of other responsibility plans. This style of policy may be especially valuable for individuals along with high web worth who possess significant assets to protect.

For instance, if you are included in a auto collision and are discovered responsible for leading to significant personal injuries to one more vehicle driver, your automobile insurance coverage policy might simply cover up to a specific amount in damages. If the quantity rewarded goes over your plan limit, umbrella obligation insurance would deal with the ext